Driver Inc.: The Canadian Trucking Scam

How some Canadian trucking companies are cutting corners and cheating the system.

If you’ve been around Canadian trucking lately, you’ve probably heard the term Driver Inc. It isn’t a new carrier or a tech platform — it’s a shady payroll setup some fleets are using to cut costs. And it’s causing headaches across the industry.

What Is Driver Inc.?

Here’s the play:

A fleet (usually small to mid-sized carriers, though it’s spread beyond that) tells its drivers to go incorporate a numbered company — something like “123456 Ontario Inc.”

Instead of paying those drivers as employees, the fleet now pays invoices to the numbered company.

On paper, the driver looks like an independent business.

In reality, nothing changes: the driver is still hauling the fleet’s trailers, on the fleet’s dispatch schedule, using the fleet’s insurance, and following the fleet’s rules.

The only real change is that the carrier dodges employment obligations like CPP, EI, workers’ comp, overtime, vacation pay, and health benefits.

Why Carriers Do It

Lower payroll costs: No employer contributions to CPP/EI or provincial workers’ comp.

No employee rights: No overtime, paid time off, or termination rules to follow.

Tax shifting: The burden gets dumped on the driver, who may not realize the risks until tax season.

Why It’s a Problem

Drivers lose protections: They miss out on EI, CPP contributions, and safety coverage. If CRA audits, they may owe back taxes.

Legit fleets get undercut: Compliant carriers are stuck competing with artificially low operating costs.

The industry takes a hit: Lower wages, higher turnover, and reputational damage.

Government loses revenue: Billions in taxes and premiums never get collected.

The Canadian Trucking Alliance (CTA) calls Driver Inc. “tax evasion,” and the government is now auditing fleets that use it.

How Is This Different from an Owner-Operator?

This is the obvious question — and the answer is simple.

A true owner-operator invests in their own truck, pays their own insurance, controls their business decisions, and leases on to a carrier under a contract. They decide when and how they work, even if they rely on one carrier for freight.

A Driver Inc. “contractor” doesn’t own the truck, doesn’t control the work, and has no real independence. They’re employees in everything but name — only reclassified to save the carrier money.

Think of it this way: Owner-ops carry business risk. Driver Inc. drivers carry tax risk.

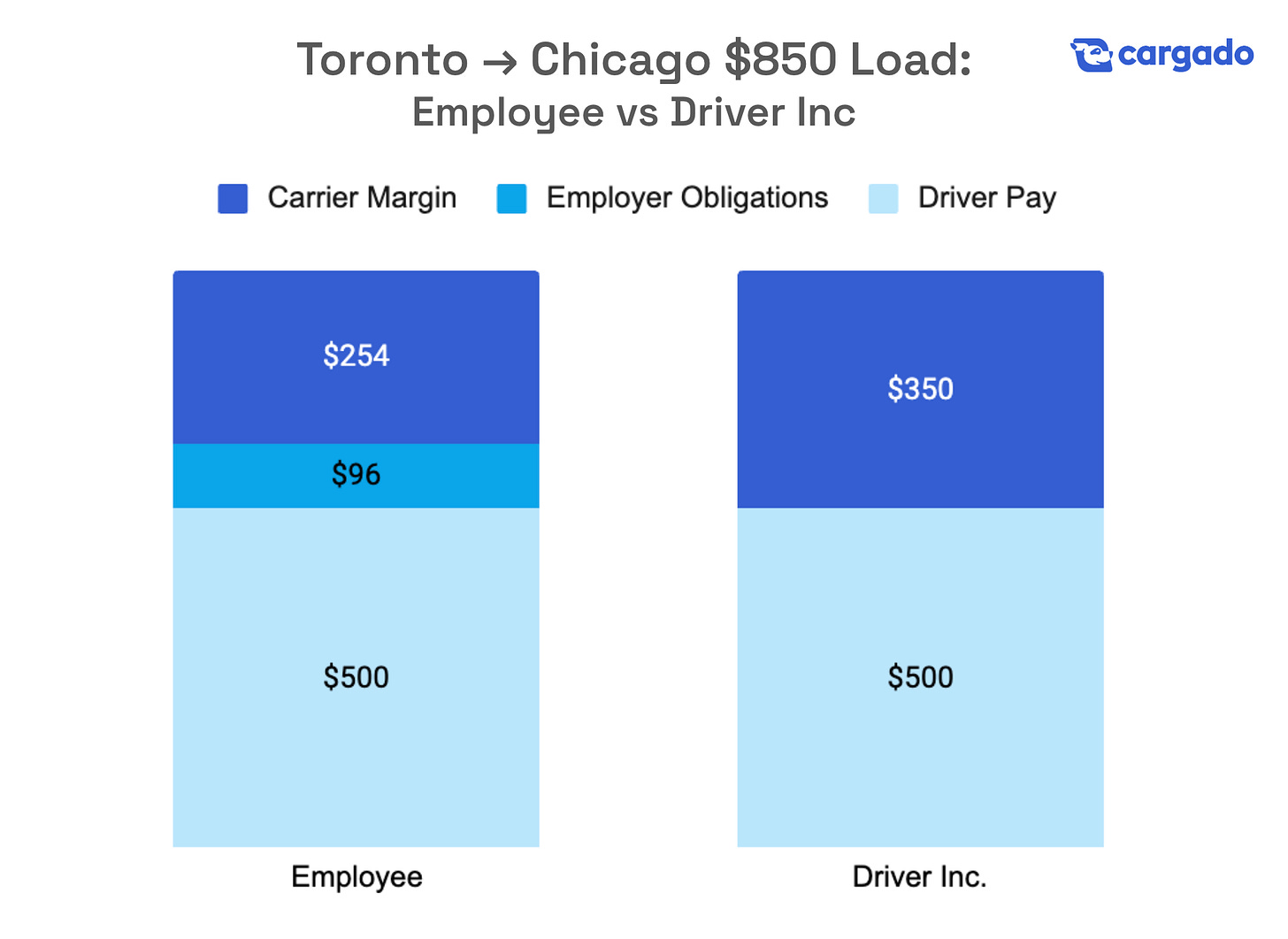

Show-Me-the-Money: Toronto → Chicago on $850

Here’s a simple example: one fleet invoices $850 USD for a Toronto-to-Chicago load.

With a driver paid as an employee, the carrier covers not just wages but also payroll obligations (CPP, EI, workers’ comp, vacation pay).

With Driver Inc., the fleet pays only the invoice — none of those obligations.

Same truck. Same freight. Same driver pay. The only difference is compliance.

Why Brokers and Shippers Should Care

You may not be the one hiring drivers directly, but it still matters:

Compliance risk – Freight moving under Driver Inc. carriers could attract regulator scrutiny.

Service instability – Drivers without protections churn faster, hurting capacity reliability.

Rate distortion – Artificially low costs create an uneven playing field in the carrier market.

Sustainability – Partnering with compliant fleets reduces long-term supply chain risk.

Bottom Line

Driver Inc. isn’t innovation — it’s misclassification. It pits compliant carriers against rule-breakers, exposes drivers to risk, and creates downstream headaches for brokers and shippers.

The takeaway for the industry is clear: ask your carrier partners how they classify their drivers. Supporting compliant operators isn’t just the right thing to do — it’s how you build a more stable, reliable supply chain.

👉 Stay updated on the latest in cross-border logistics and freight tech by subscribing at CongratsOnAllTheProgress.com.