I just wrapped up two Mexico 101 webinars, and the turnout blew me away. Almost 90 people showed up to the first one. The questions were sharp.

One attendee asked, “Why would a shipper use a broker for Mexico when they could build an in-house team?” Another pushed on security concerns. Someone else wanted to know how to pitch door-to-door freight to customers who are currently transloading at the border. These are exactly the questions you should be asking.

What stood out wasn’t the complexity — it was how ready brokers are to lean in. They’re not afraid of Mexico freight. They’re afraid of what they don’t know.

Here’s the truth: Mexico freight isn’t some distant opportunity you need to chase. It’s already sitting in your book. You just need to know where to look — and have the confidence to go after it.

1. Scan Your Book for Border City Activity

Here’s the prospecting hack no one talks about: look at where your customers are already shipping domestically.

Pull any loads moving to or from Laredo, El Paso, Pharr, Nogales, or Calexico. These are the major crossing points — and if freight is touching them, there’s a good chance the full cross-border lane is available.

“Hey, I noticed you ship to Laredo a lot — are you working with anyone for freight into Mexico?” That’s your entry point.

Even better: look for border forwarders or warehouses in your customer base. Many shippers are transloading at the border when they could be running door-to-door. That conversion alone can save them $125–$250 per load in transload fees — and it’s a conversation worth having.

One question that came up in the webinar: “How do you introduce a customer to the possibility of door-to-door freight instead of what they’re currently doing?” The answer is simple — lead with cost savings and visibility. When they transload, they lose control. When they run door-to-door, they know exactly when freight is picking up, crossing, and delivering. That control is worth money to them.

Nearshoring has made this even more relevant. Manufacturers are moving production to Mexico at an explosive rate. If you’re handling domestic freight for companies in automotive, electronics, machinery, or food — they probably have Mexico needs. You just haven’t asked.

2. Walk a Store and Read Labels

This one sounds simple, but it works.

Walk through a grocery store, Home Depot, or any big-box retailer and look for “Hecho en México” on the packaging. Appliances, furniture, produce, auto parts, building materials — a massive amount of what we buy comes from Mexico.

Now trace it back. Who’s the supplier? Who’s the importer? Those are your prospects.

You’re not cold-calling random Mexican companies with Google Translate. You’re targeting U.S. businesses with Mexico supply chains who already understand the value of cross-border freight. These are companies that have freight moving right now — freight that’s stickier and outside the RFP cycle.

During one of the webinars, someone asked about open-deck safety for equipment moves. It’s a fair question — and the answer is that security on open-deck depends heavily on the carrier and the lane. CTPAT-certified carriers, proper securement, and knowing your routes matter more than the trailer type. The point is: the freight is there, and it’s valuable.

3. Target the Right Industries

Not all Mexico freight is created equal. The stickiest lanes tend to come from a handful of industries:

Automotive — Tier 1 and Tier 2 suppliers feeding OEM plants. Think parts flowing from Monterrey and Saltillo to assembly plants in the Midwest. Production schedules are tight, and reliability wins over price.

Retail & Distribution — Home Depot, Walmart, and their vendor networks. These companies are pulling product from Mexican suppliers into U.S. distribution centers. Volume is consistent, and they’re used to working with brokers.

Appliances & Furniture — Heavy nearshoring activity here. If you’ve bought a refrigerator or a couch in the past few years, there’s a decent chance it came from Mexico.

Food & Beverage — Produce, packaged goods, ingredients. The cold chain adds complexity, but the volume is consistent.

Industrial & Construction — Raw materials, components, heavy equipment. These moves often require specialized trailers and reliable service.

These industries have consistent volume, tight service requirements, and a willingness to pay for reliability.

4. Know Enough to Be Dangerous — Not an Expert

The number one thing I heard in these webinars: “I don’t know enough about how it works.”

Fair. But here’s the thing — you don’t need to be a customs expert. You need to understand the basics well enough to have a conversation.

Here’s what you actually need to know:

Cross-border freight involves multiple handoffs. A U.S. carrier takes it to the border. A transfer (dray) carrier moves the trailer across. A Mexican carrier delivers to the final destination. For northbound freight, it’s the reverse. This isn’t complicated — it’s just different from domestic.

Customs clearance adds 1–3 days. Don’t promise domestic-style transit times. Build in the border stop and you’ll set realistic expectations. If you tell a customer it’s a 4-day transit and it takes 6, you’ve lost trust. If you tell them 5–6 days and you deliver in 5, you’re a hero.

Customs brokers do the hard work. Your job isn’t to know every HTS code or CBP requirement. It’s to make sure your customer has a customs broker and that you’re coordinating timing with them. Ask your customer to introduce you to their broker — don’t cold-email them.

One of the sharpest questions from the webinar: “If we book a carrier that uses a transfer partner in Mexico, will we have visibility into that partner? I’m asking from a liability perspective.” Great question. The answer depends on the carrier and the platform. With Cargado, we show you the full chain — the U.S. carrier, the transfer, and the Mexican carrier. Visibility matters, especially when claims happen.

When you can walk a customer through all of this, they trust you. Most shippers don’t know how Mexico freight moves either. When you explain it confidently, you win business.

5. Don’t Build the Network Yourself — Leverage One

Here’s where Cargado comes in.

The hardest part of cross-border used to be capacity. How do you find vetted Mexican carriers? How do you communicate across languages and time zones? How do you get real rates without waiting three days for a quote?

That’s exactly what we built.

Cargado gives you instant access to pre-vetted carriers on both sides of the border. You get instant rate guidance so you can quote quickly. You get a bilingual platform so you’re not chasing emails and WhatsApp messages across languages. And you get visibility into what’s happening at every stage — including inside Mexico, where most tracking tools go dark.

During the webinar, someone asked how carrier vetting works. We vet carriers against multiple data sources, with a deep set of requirements and references required as well. All of it gets checked before a carrier can book a load.

You don’t need to spend years building a Mexican carrier network. You need to say yes to your customer and post the load.

The Bigger Picture: Tariffs and Nearshoring

One question that came up in both webinars: “What about tariffs and nearshoring?”

The short answer — this is a tailwind, not a headwind.

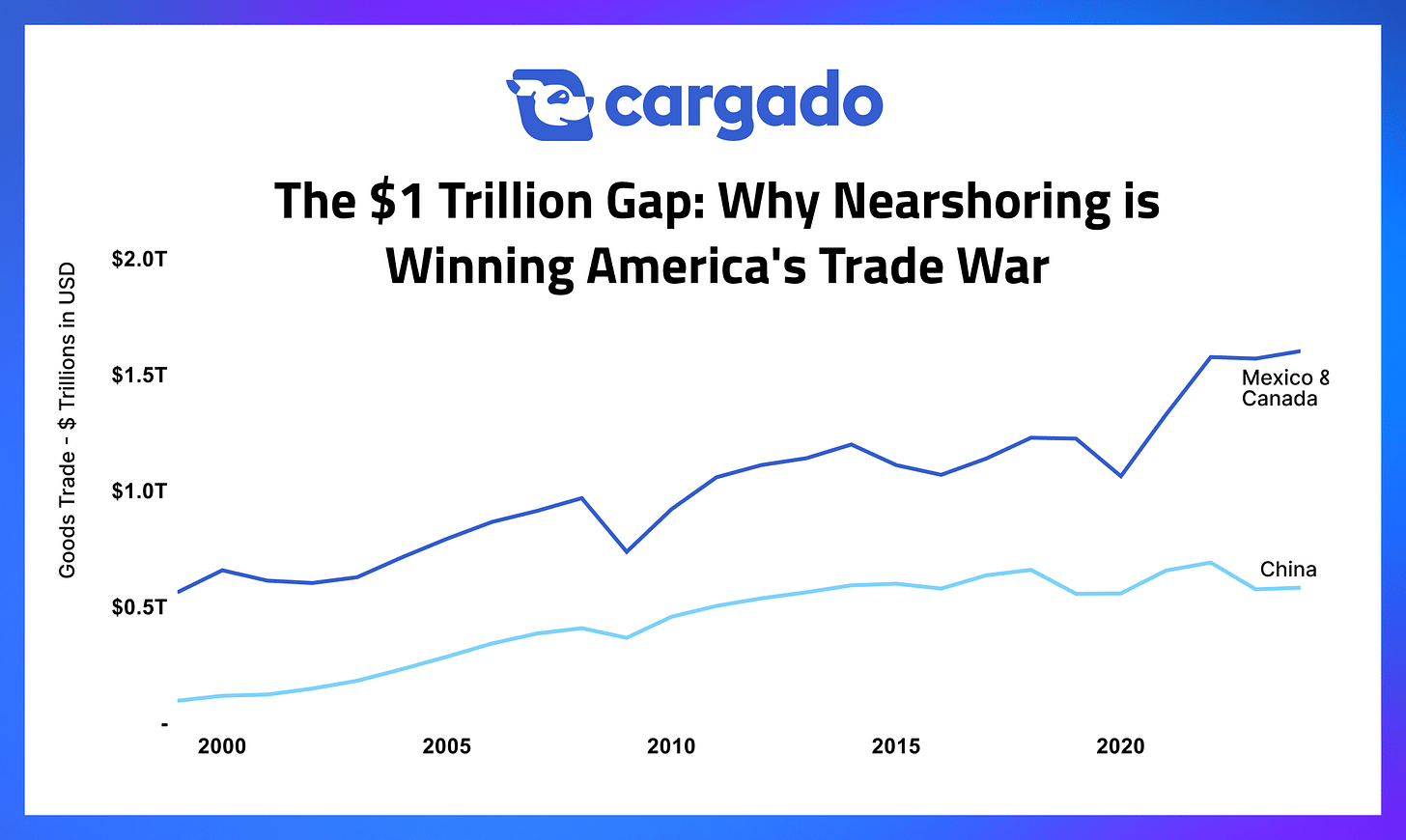

Look at the chart at the top of this post. In 2000, U.S. goods trade with China was nearly zero. Trade with Mexico and Canada sat around $600 billion. Fast forward to today: China trade has grown to roughly $600 billion — but North American trade has exploded to over $1.6 trillion. That’s a $1 trillion gap, and it’s only getting wider.

The story is clear. While everyone was focused on China’s rise, North America quietly became the dominant trade relationship. And that trend is accelerating.

With 4–8 day lead times from Mexico versus 2–4+ weeks from China, manufacturers are moving production closer. The pandemic exposed how fragile long supply chains are. Tariffs — existing and potential — make near-shore production more economically attractive. And USMCA (which replaced NAFTA) gives Mexico preferred trade status that China doesn’t have.

That means more freight. More opportunity. And brokers who learn this now will dominate the next five years.

Mexico isn’t a niche. It’s the #1 U.S. trade partner. The brokers who lean in now will be the ones with the expertise and relationships when everyone else catches up.

The Brokers Who Win Are the Ones Who Show Up

The questions in these webinars told me something important: the brokers who are ready to learn are the ones who are going to grow.

Mexico freight isn’t some specialty you need a whole team for. It’s a wedge into accounts you couldn’t touch before — outside the RFP cycle, with stickier revenue. One Mexico load often becomes a multi-lane, recurring relationship.

If you missed the webinar, don’t worry — we’re running more. But don’t wait for another session to start.

Look at your book first. The freight is already there.

Join the Next Mexico 101 Webinar

Want to go deeper? I’m running more sessions where we break down everything — from quoting your first cross-border load to building a repeatable Mexico freight book. These are live, interactive, and built for brokers who want to actually move freight, not just learn theory.

Check the schedule and register at cargado.com/webinars.

See You in Laredo

If you want to take your cross-border knowledge to the next level, join us at the Cross-Border Connector on February 17–18, 2026 in Laredo, Texas. It’s powered by Broker-Carrier Summit and Cargado — two days of networking, learning, and connecting with the people who move North American freight.

This is where brokers, carriers, and shippers come together at the busiest land port in the Western Hemisphere. If you’re serious about Mexico freight, this is the room to be in.

And if you’re ready to start moving freight today, get on Cargado. Your competition sure is.

Stay updated on the latest in cross-border logistics and freight tech by subscribing at CongratsOnAllTheProgress.com.